House price inflation only fell marginally throughout the country after the emergence of the Covid-19 pandemic, according to the latest house price report from MyHome.ie.

The report, which is published in association with Davy, found that quarterly asking price inflation fell by 1.5% nationally, by 2.1% in Dublin, and by 0.9% elsewhere around the country. Annual asking price inflation fell by 2.9% nationwide and by 2.6% in Dublin.

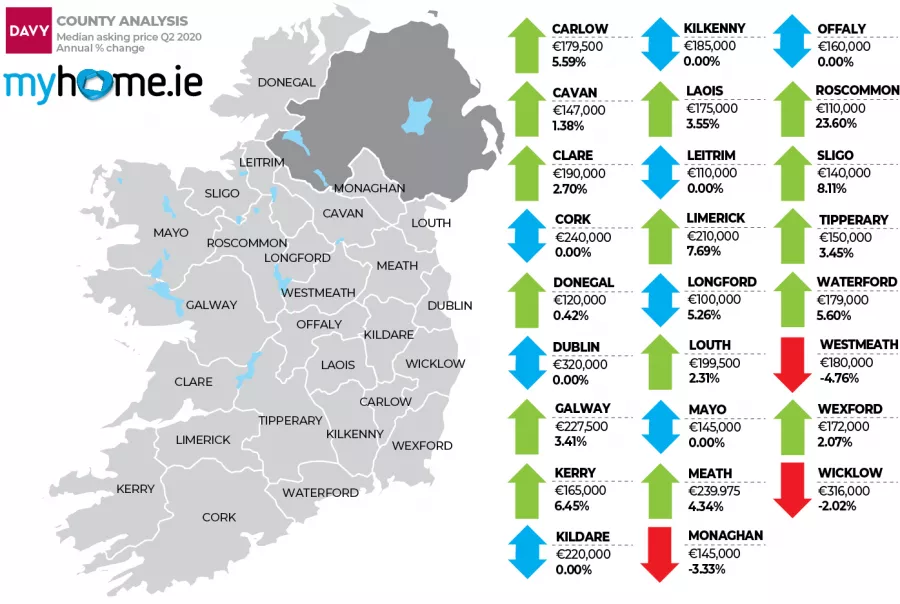

This means the mix-adjusted asking price for new sales nationally is €268,000, while the price in Dublin is €372,000 and elsewhere around the country it is €224,000. Newly listed properties are seen as the most reliable indicator of future price movements.

The author of the report, Conall MacCoille, Chief Economist at Davy, said that the negative asking price inflation seen throughout the country had to be viewed in the context of far fewer listings in Q2 compared to a year ago. “Our price measure is based on just 3,700 new properties listed for sale over the past three months, down 64% from 10,200 one year ago. Observed prices were therefore clearly biased towards those vendors willing to put their homes on the market despite the enormous uncertainty of the Covid-19 outbreak.”

He added that despite a highly uncertain outlook for the property market, there was cause for some optimism. “The negative impact of Covid-19 could still have a more slow burn impact on the Irish housing market than many participants anticipate. That said, the clear anecdotal evidence is that activity in the housing market is returning to normal levels and with greater confidence than estate agents had expected.”

Angela Keegan, Managing Director of MyHome.ie, said the significant drop-off in activity in Q2 meant that a clearer picture of Covid-19’s effect would not be seen until Q3. “With activity significantly down on normal levels for most of the quarter, it is perhaps not hugely surprising that we have seen prices stay relatively steady as many buyers adopt a wait and see approach. In Q3 we will have a better sense of how the overall economic picture has affected the housing market across the country.”

Full details of the report can be found at www.myhome.ie/reports

#MyHomeDavy

For further information, contact:

Julian Fleming (087-6915147)